Let's start with

some headline numbers, some eye-popping numbers. In the 1.5 mile stretch from the northern

edge of town near the TA to the first 4-way stop in the Parowan Valley (see map

in Prologue), we recorded 555 aluminum cans in the ditch. My reader may not feel that this is any big

deal, but it seems like a lot to me.

Moreover, I walked a portion of this road myself about two years ago and

collected a hundred cans for recycling.

So, I know for certain that these new numbers underestimate the true

volume of trash. But, even at the rate

of 555, that equals one can every 14 feet.

We divided the

census data into three families: Beer,

Caffeine, and Fruit. While everyone

knows (and loves) beer, the latter pair of groupings can sometimes be difficult

to distinguish. For example, what is

"MUG Root Beer?" Is it

caffeine or fruit? I don't know. I don't know if it has caffeine. If it doesn't have caffeine, it should be

typed as "fruit," by which we mean non-caffeinated sweet drinks. Ultimately, though, it doesn't matter a lot

because these categories—especially fruit—turned out to play only a minor

role in our data collection. In fact, at

this site only seven of the 555 cans were finally classified as "fruit,"

or just a shade over 1% of the roadside trash.

Either fruit drinkers are not very trashy, or they are not very

common. As for caffeine, the numbers

were quite a bit larger, but still made up only a small percentage of the total

(around 8%). Just to provide a feel for

what kind of caffeine is being consumed (and ditched) in the Parowan Valley,

the top three vote-getters were Mountain Dew (16 cans), Pepsi (9 cans), and

Monster (5 cans). No other caffeinated

drink scored even five votes.

So, if the Caffeine

and Fruit families account for just nine percent of the can trash at our first

data collection site, what does that say about Beer? Wow.

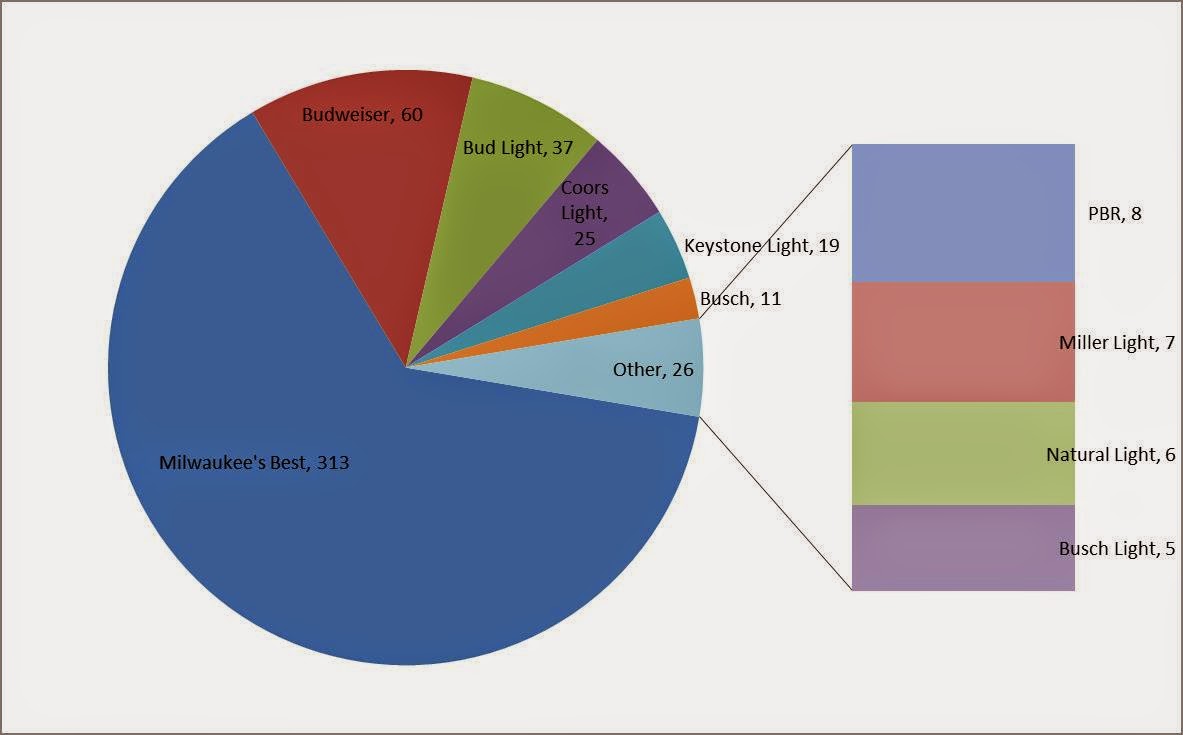

We counted 503 beer cans in 1.5 miles, or one every 16 feet. In addition, there were 16 different species

of beer. Which is to say that we

identified 16 different labels. Of

these, we decided that six of them were of low importance—occurring fewer than

four times each. These were Milwaukee's

Best Ice, Coors, Hurricane Malt Liquor, Bud Ice, Pacific Western Traditional

Lager, and Icehouse. The ten remaining

beer species—shown in the pie chart—accounted for 88% of our data, so we

began to concentrate our trash analysis on these brands of beer and their drinkers.

After taking a quick

look at these data, we immediately wanted to know what was being sold, and for

how much, at the TA truck stop nearby.

It is axiomatic that correlation is not causation, so we're not saying

this proves anything, but the truck stop sells just five brands of suitcase

beer. (I don't want to spend a lot of

time on this, but we have become somewhat convinced that this particular type

of can traffic is associated with beer that you buy in a cardboard

suitcase.) These are Milwaukee's Best,

Budweiser, Bud Light, Coors Light, and Keystone Light. Well.

Are people driving 54 miles—the distance between Beaver and Cedar City,

the only other two sources of beer—to buy Milwaukee's Best, drink it, and

throw the can in the Parowan Valley? We

think not. But, before we begin

speculating on behavior, let's discuss cost.

For a 12 can suitcase at the TA Milwaukee's Best costs $7.99 ($.67/can);

Bud and Bud Light go for 13.89 ($1.16/can); Coors Light is $13.59 ($1.14/can);

and Keystone Light is $10.29 ($.89/can).

Let me save the

worst of the speculation for the portion of this paper that comes after all the

data have been presented. For now, let

me offer a few observations:

*Despite the name,

Milwaukee's Best is not famous for stimulating the palate. As a much younger man I remember drinking it

for certain other reasons. In fact, for

a while the brand was widely known as "The Beast," referring I

presume to how I looked the next morning.

*All of the beer

sold in suitcases at truck stops in Utah has an alcohol content of 3.2%. All of it.

So, you can't charge more for a higher alcohol content like you might

elsewhere. Despite this fact,

Anheuser-Busch, with its two brands—Bud and Bud Light—is selling quite a bit

of beer at almost double the per can cost of Miller-SAB's

"Best." Is Budweiser really

worth twice as much? Of all the money

spent on beer in this sample, Anheuser is collecting 30% of it. How are they doing that with beer that is

hard to distinguish from, um, other yellowish liquids? Actually, I have no idea. I wonder if it is the marketing? I mean, from what I hear, the Super Bowl is

trying to buy television time to run advertisements during the Bud Bowl.

*The pricing

strategy of the third big brewer—Molson Coors—doesn't make sense to me. At least at this location, it seems to be a

failed strategy. They are not really

competitive at the high end, where their pricing is similar to Anheuser. (Although, remember, this is

speculative. Coors Light may be selling

very well. But Silver Bullet drinkers

may not be can tossers, which would clearly impact our conclusions.) But, they are really struggling at the low

end, where the price point of $10.29 for a suitcase of Keystone Light is almost

incomprehensible. It is not cheap enough

for the cost conscious and not expensive enough for the status conscious.

No comments:

Post a Comment